Market Outlook

February 08, 2018

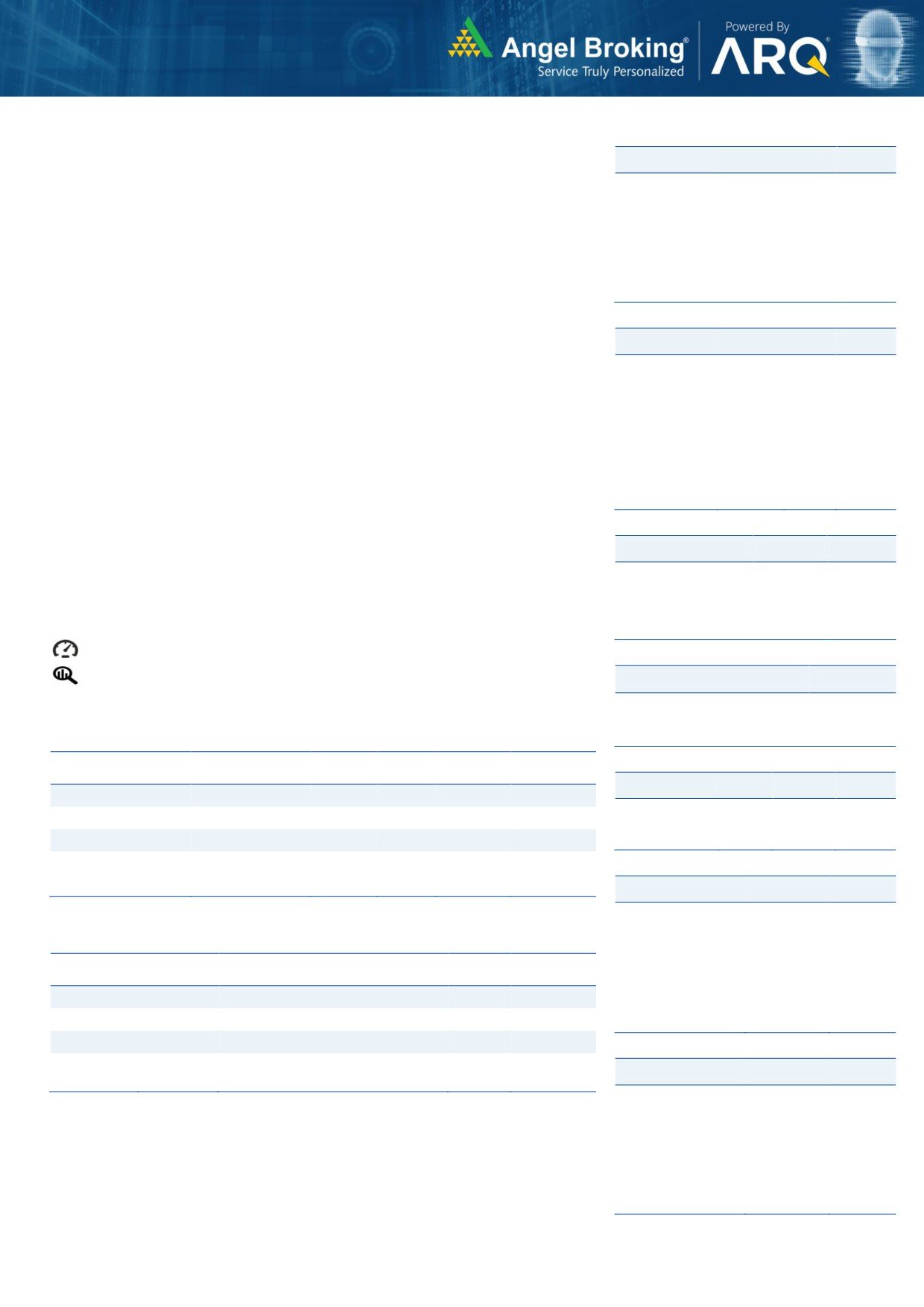

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open positive tracking global indices and SGX Nifty.

BSE Sensex

(0.3)

(113)

34,083

US stocks tumbled in the final hour of trading to finish near the unchanged line,

Nifty

(0.2)

(22)

10,477

as markets remained skittish after Monday's crash.The Dow Jones ended on

Mid Cap

0.4

70

16,351

downside front of 0.1% to close at 24,893 and the Nasdaq Composite edged down

Small Cap

2.0

340

17,732

to 0.9%, to 7,052.

Bankex

(0.4)

(125)

29,072

U.K. shares edged higher after the U.S. markets recovered from an early plunge to

finish sharply higher overnight. The FTSE 100 was up by 1.9% to close at 7,279.

Global Indices

Chg (%)

(Pts)

(Close)

Dow Jones

(0.1)

(19)

24,893

On domestic front, Indian shares closed lower for the seventh straight session as

Nasdaq

(0.9)

(64)

7,052

global sentiment changed from unbridled optimism to skepticism and the RBI

warned of higher government spending feeding into inflation after keeping interest

FTSE

1.9

138

7,279

rates unchanged for a third straight meeting, as widely expected. The Sensex ended

Nikkei

0.2

46

21,692

on a downside front of 0.3% at 34,083 while the Nifty ended at 10,477 with a

Hang Seng

0.8

242

30,565

downside of 0.2%.

Shanghai Com

(0.8)

(26)

3,283

News Analysis

Advances / Declines

BSE

NSE

YES Bank raises Rs 38.47bn for five-year tenor through global bonds

Advances

2,028

1,387

Detailed analysis on Pg2

Declines

767

402

Investor’s Ready Reckoner

Unchanged

92

48

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Volumes (` Cr)

Refer Pg5 onwards

BSE

4,396

NSE

33,746

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Buy

732

867

18.5

FII

(1,718)

(346)

12,638

Dewan Housing Finance

Financials

Buy

500

712

42.3

Asian Granito

Other

Buy

507

651

28.5

*MFs

1,312

950

8,336

Navkar Corporation

Other

Buy

172

265

53.9

KEI Industries

Capital Goods Accumulate

390

436

11.9

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg4

Centuryply

338

15.2

Key Upcoming Events

Chamblfert

158

11.8

Previous

Consensus

Date

Region

Event Description

Rain

362

9.6

Reading

Expectations

Lti

1,294

9.2

Feb08

India

RBI Cash Reserve ratio

4.00

4.00

Feb08

China

Exports YoY%

10.90

10.70

Bajajelec

487

9.0

Feb08

China

Consumer Price Index (YoY)

1.80

1.50

Feb09

UK

BOE Announces rates

0.50

0.50

Top Losers

Price (`)

Chg (%)

Feb09

UK

Industrial Production (YoY)

2.50

0.30

More Events on Pg7

Natcopharm

831

(8.1)

Vakrangee

203

(5.0)

Redington

140

(4.5)

Ubl

1,080

(4.2)

Bayercrop

3,930

(3.9)

As on February 07 2018

Market Outlook

February 08, 2018

News Analysis

YES Bank raises Rs 38.47bn for five-year tenor through global bonds

Private sector lender Yes Bank has raised $600 million (over Rs 38.47 billion) by

issuing bonds in the international debt markets. The bonds will be listed on the

London Stock Exchange International Securities Market (LSE ISM), the Singapore

Exchange Securities Trading SGX, and the India International Exchange IFSC at

GIFT City, Gandhinagar.

The bond issuance is aligned to government's commitment of building a high-tech

financial hub in the country. The bond is rated Baa3 by Moody's Investors Service

and has tenor of 5 years

Economic and Political News

India's tea exports hit 36-year high, reach at 241mn kg in 2017

RBI warns Budget 2018 may feed inflation as rates left on hold

Supreme Court cancels all iron ore mining permits in Goa

Corporate News

RITES may get into station development by acquiring 25% stake in IRSDC

Honda to wait for policy clarity before firming up EV plans in India

Jaguar Land Rover posts 3% increase in global sales at 49,066 units in Jan

Idea suspends interconnect services to Aircel over non-payment of dues

Market Outlook

February 08, 2018

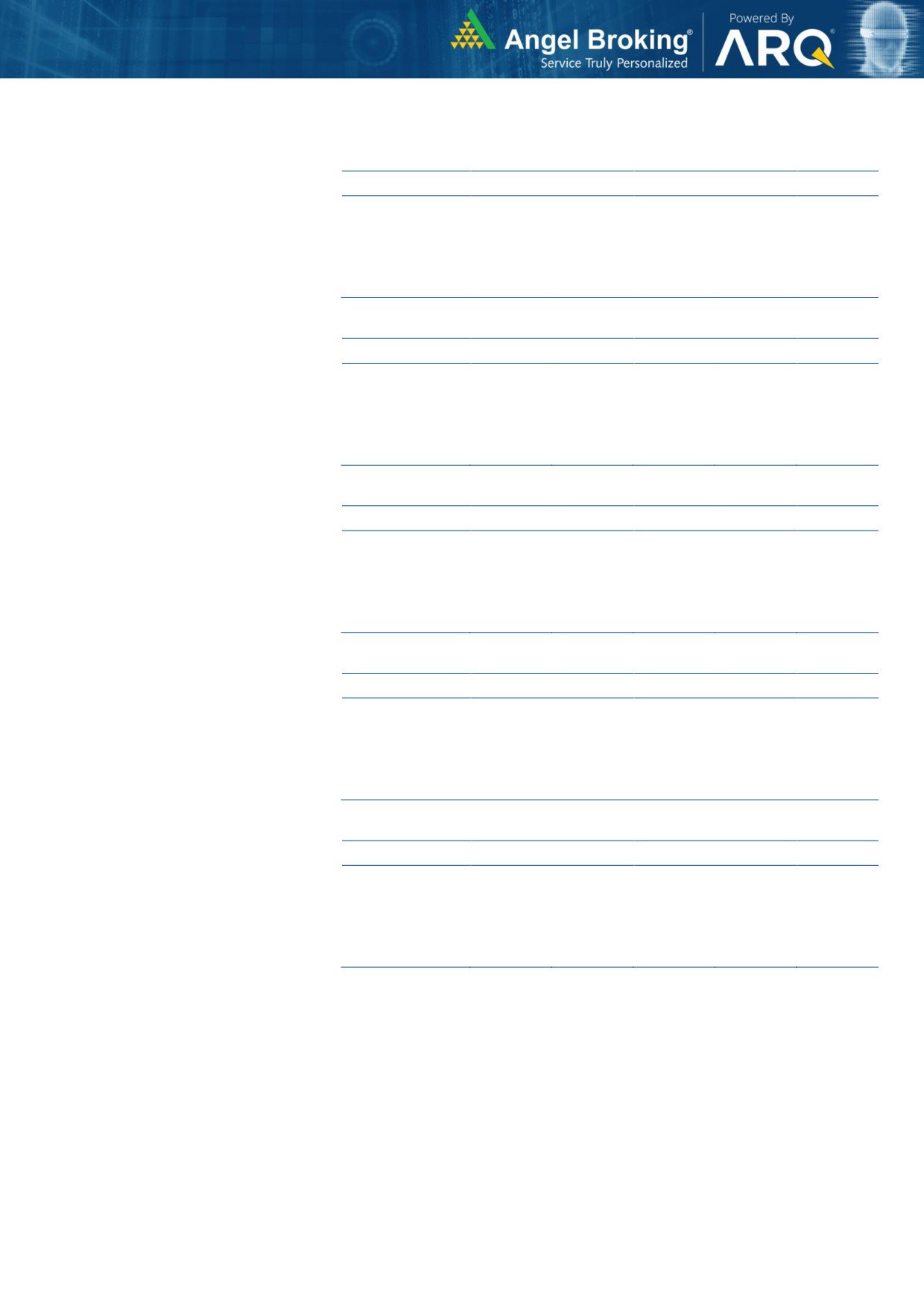

Quarterly Bloomberg Brokers Consensus Estimate

Bhel Ltd - Feb 08, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

7,621

6,320

20.6

6,384

19.4

EBIDTA

293

223

31.4

(95)

-

%

3.8

3.5

(1.5)

PAT

373

93

301.2

115

224.4

Petronet Ltd. - Feb 08, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

8,222

6,299

30.5

7,770

5.8

EBIDTA

862

607

42.1

898

(4.1)

%

10.5

9.6

11.6

PAT

545

397

37.3

588

(7.3)

ABB Ltd. - Feb 08, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

2,911

2,493

16.7

1,915

52.1

EBIDTA

320

301

6.3

134

138.1

%

10.9

12.1

7.1

PAT

191

158

20.8

83

130.1

Glenmark Pharma Ltd. - Feb 08, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

2,189

2,535

(13.6)

2,256

(2.9)

EBIDTA

415

765

(45.7)

388

6.9

%

18.9

30.2

17.2

PAT

229

477

(51.9)

214

7.1

Cadila Healthcare Ltd. - Feb 08, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

3,151

2,311

36.4

3,234

(2.5)

EBIDTA

836

404

106.9

857

(2.4)

%

26.5

17.5

26.5

PAT

537

323

66.3

503

6.8

Market Outlook

February 08, 2018

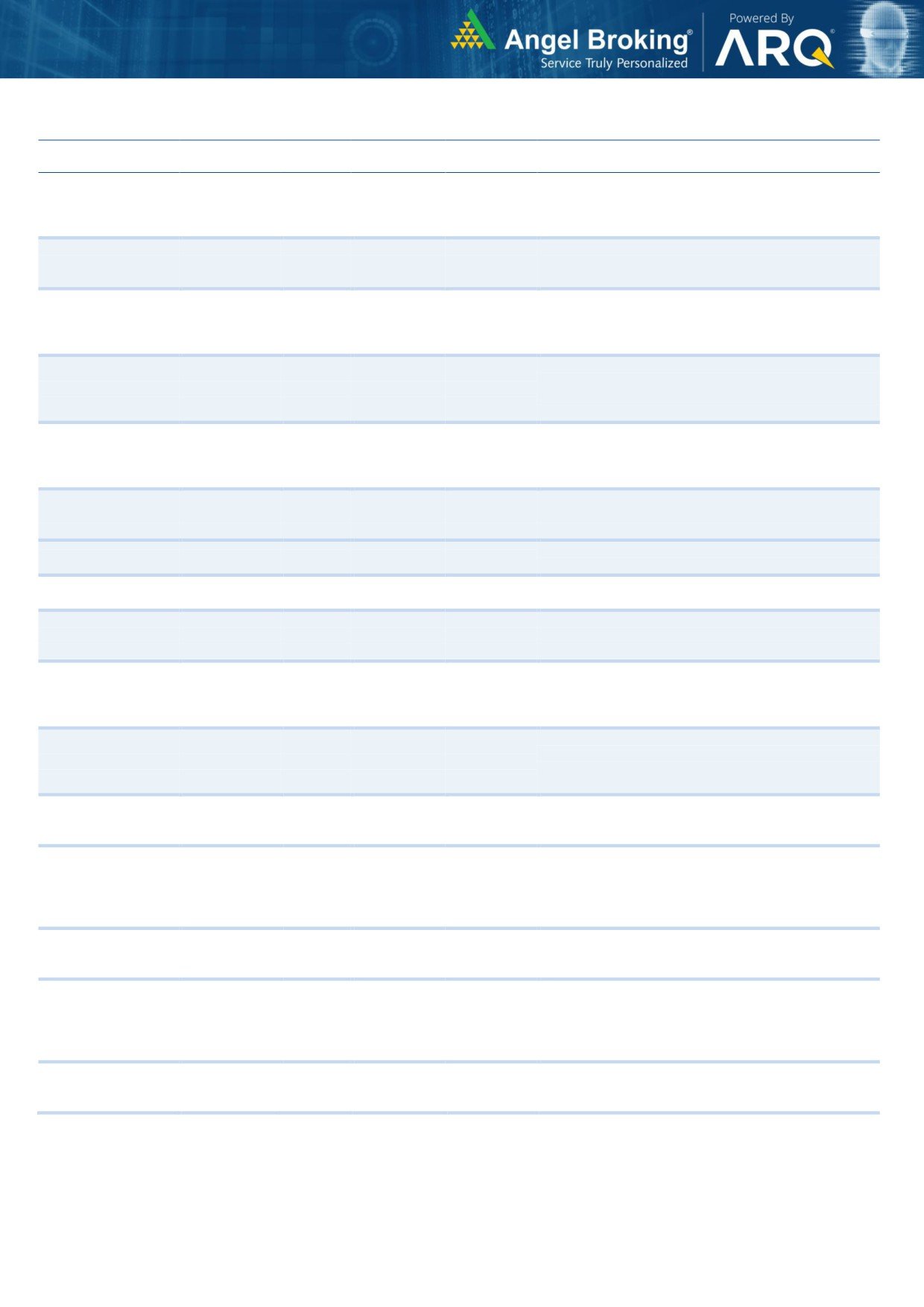

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leade`hip

in acute therapeutic segment. Alkem expects to launch

Alkem Laboratories

25,829

2,160

2,441

13.0

more products in USA, which bodes for its international

business.

We expect the company would report strong profitability

Asian Granito

1,525

507

651

28.5

owing to better product mix, higher B2C sales and

amalgamation synergy.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

7,022

732

867

18.5

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

15,689

500

712

42.3

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Lower credit cost will help in strong bottom-line growth.

Karur Vysya Bank

8,198

113

160

41.8

Increasing share of CASA will help in NIM

improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

3,053

390

436

11.9

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast

1,947

341

475

39.2

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

2,592

172

265

53.9

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

2,992

638

851

33.3

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no.

2

viewership ranking in English news genre, exit from the

TV Today Network

2,790

468

500

6.9

radio business, and anticipated growth in ad spends by

corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The Gujarat

Maruti Suzuki

2,69,452

8,920

10,619

19.0

plant will also enable higher operating leverage which

will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,147

399

655

64.3

year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to healthy

7,459

336

400

19.1

growth in plywood & lamination business, forayed into

Century Plyboards India

MDF & Particle boards on back of strong brand &

distribution network.

We expect sales/PAT to grow at 13.5%/20% over next

LT Foods

2,819

88

128

45.2

two years on the back of strong distribution network &

addition of new products in portfolio.

We expect sales/PAT to grow at 13%/16% over next two

years on the back of strong healthy demand in writing

Ruchira Papers

394

176

244

39.0

& printing paper and Kraft paper. Further, China had

banned making paper from waste pulp which would

benefit Indian paper companies.

We expect financialisation of savings and increasing

Aditya Birla Capital

36942

163

230

41.2

penetration in Insurance & Mutual fund would ensure

steady growth.

Source: Company, Angel Research

Market Outlook

February 08, 2018

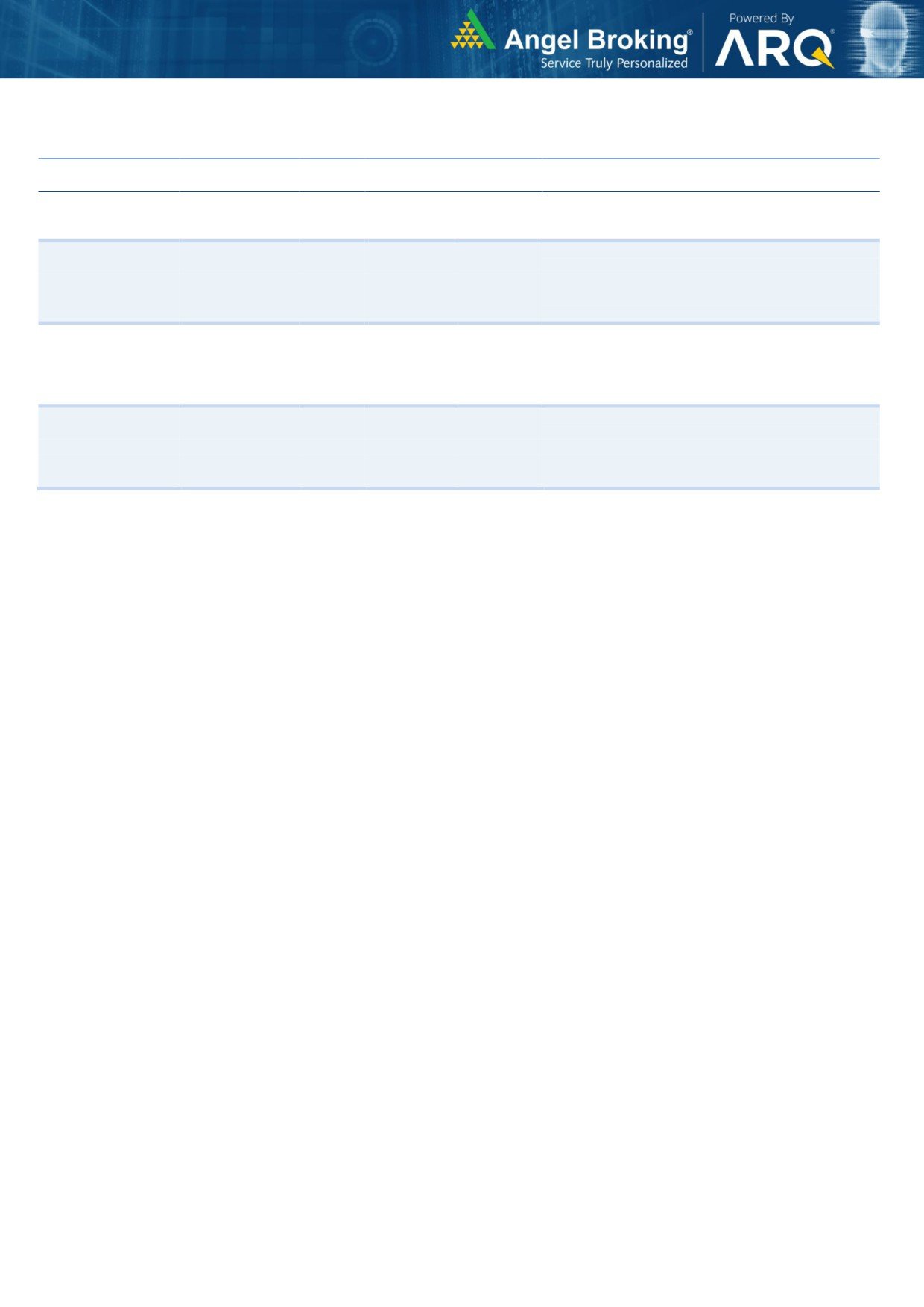

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,993

300

360

19.9

over FY18-20 backed by capacity expansion and new

geographical foray

We forecast Nilkamal to report top-line CAGR of ~9%

to `2,635cr over FY17-20E on the back of healthy

Nilkamal

2,518

1,688

2,178

29.1

demand growth in plastic division. On the bottom-line

front, we estimate ~10% CAGR to `162cr owing to

improvement in volumes.

We expect sales/PAT to grow at 9%/14% over next two

years on the back of healthy demand growth in

Shreyans Industries

242

175

247

40.8

printing. Further, China had banned making paper

from waste pulp which would benefit Indian paper

companies.

The prism has diversified exposure in the different

segment such as Cement, Tile & ready mix concrete.

Prism Cement

6,133

122

160

31.3

Thus we believe, PCL is in the right place to capture

ongoing government spending on affordable housing

and infrastructure projects.

Source: Company, Angel Research